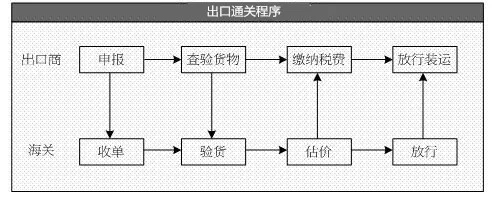

The core steps of export customs clearance rely on two aligned workflows—one centered on the exporter and the other on the customs agency. For exporters, the process boils down to four main stages: declaration, cargo inspection, duty payment (when required), and final shipment approval. From customs’ side, the steps are document acceptance, cargo verification, value assessment, and release. Here’s a closer look at each:

Known commonly as "customs declaration," this is a mandatory legal step. It applies to the operator of inbound/outbound transport, the shipper/consignee of import/export goods, or their authorized representative, who must:

When export goods arrive at a customs-controlled port, file a detailed goods report with China Customs using either paper documents or Electronic Data Interchange (EDI) within the deadline set by Customs;

Include supporting shipping and commercial documents to request customs inspection and approval;

Take legal accountability for the truthfulness and precision of the information declared.

Key Rules for Export Declaration Timing and Content:

Timing Rules: The export shipper must submit the declaration to Customs at least 24 hours before the goods are loaded. Specifically, once the goods are delivered to a customs-approved warehouse or location (like ports, stations, airports, or post offices), the declaration must be filed within the 24-hour period before loading, as mandated by rules.

Required Declaration Details: The submission must cover full details about the export goods, including:

Goods’ business entity, shipper/consignee, and declaring party;

Transport method, trade category, and trade country/region;

Goods’ actual characteristics (name, specs/model, quantity, weight, value, etc.).

Customs Declaration Form: Multiple copies are needed (the exact number varies by the requirements of relevant agencies). The form can be completed by a licensed customs broker or generated via an automated pre-entry system. For export tax refund applications, an extra yellow "Special Customs Declaration Form for Export Tax Refund" is mandatory.

Export Permit (E/P): For goods under national export restrictions or quota controls, the appropriate export permit or supporting certification must be included.

Commercial Invoice: A formal document from the shipper to the consignee that outlines the goods’ description, quantity, unit price, total value, and payment terms.

Packing List: A document that details the goods’ packaging (net/gross weight, items per package, etc.) to support customs inspection. Bulk goods or single-piece packaged items are exempt from this requirement.

Customs Clearance Form for Outbound Goods: For goods that require inspection and quarantine per national rules, this form—issued by the relevant inspection agency—is mandatory for export. In the POCIB (Practice for International Business) simulation, goods not requiring inspection (those without a "B" in customs supervision codes) don’t need this form during declaration.

Other Supporting Documents: Extra paperwork may be needed depending on the goods’ nature (e.g., certificates of origin for preferential tariff benefits) or specific customs rules.

One-to-One Service

One-to-One Service Fast Turnaround Cycle

Fast Turnaround Cycle Two Decades of Import & Export Experience

Two Decades of Import & Export Experience Numerous Successful Cases

Numerous Successful Cases

Online Consultation

Online Consultation