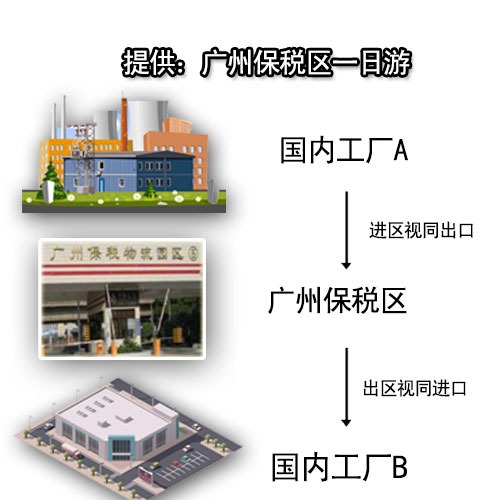

Benefits of Bonded Zone "One-Day Tour" for Factory Transfer

The "One-Day Tour" in a bonded logistics center is essentially a domestic alternative to the "Hong Kong One-Day Tour" (a traditional practice for export-related procedures). This article explains its definition, benefits, characteristics, and applicable scope, highlighting how it optimizes supply chain efficiency for enterprises.

It mainly refers to an operation method where processing trade enterprises first export domestically produced intermediate inputs to overseas locations such as Hong Kong and then complete import procedures.

Since a bonded logistics center is equivalent to a "territory within the country but outside the customs territory," enterprises do not need to conduct a "one-day tour" to Hong Kong or the high seas. Instead, they only need to move goods into the bonded logistics center for the "one-day tour" process, significantly reducing transportation costs and related expenses.

- Bonded zones are regarded as "overseas" in customs terms. The movement of goods into and out of bonded zones is deemed as import and export. Transferring goods into and out of bonded zones for factory transfer enables enterprises to claim tax rebates and verify processing trade manuals.

- Customs declaration and inspection can be completed in one batch for inbound goods, while outbound goods can be processed in multiple batches.

- It replaces the need for goods to be transported to overseas locations (e.g., Hong Kong) for similar procedures, saving logistics costs, shortening supply lead times, and reducing container yard fees.

- Fast customs clearance (1-2 hours) and simple procedures. For example, if both parties in the import-export transaction declare using processing trade manuals, clearance is feasible as long as the first four digits of their HS codes match.

- Suppliers of raw materials can enjoy preferential national export tax rebates.

For upstream enterprises: Once goods enter the bonded logistics center, it is regarded as export, and tax rebates can be claimed immediately.

For downstream enterprises: They only need to import goods from the bonded logistics center and declare the import using a "processing trade manual" to enjoy the benefit of exemption from customs duties and value-added tax (VAT) on imported materials.

This significantly shortens the tax rebate cycle and accelerates capital flow.

- ① Generated by manual transfer between processing trade manuals

For example, if "deep processing transfer" (factory transfer) is chosen, the transaction between the two enterprises will be recognized as domestic trade by tax authorities, and no export tax rebate will be granted. The "one-day tour" solves this issue by qualifying the transaction as export-import, enabling tax rebates. - ② Processed trade (manual) finished products containing domestic materials

Example: Enterprise A exports a ship and requires thousands of imported materials. Enterprise B is a supplier of one of these imported materials. If B directly delivers the materials to A, B cannot claim a tax rebate. However, if B first exports the materials to the bonded logistics center, and then A imports the materials from the center, B can successfully obtain the tax rebate. This is undoubtedly beneficial for all enterprises similar to B. - ③ Differences in tax rebate rates (semi-finished products > finished products)

Example: Wide coil steel needs to be processed into narrow strip steel for export. Since the tax rebate rate for wide coil steel is higher than that for narrow strip steel, enterprises can conduct a "one-day tour" of the wide coil steel in the bonded logistics center to complete the tax rebate for the wide coil steel. The downstream enterprise then imports the wide coil steel using a manual and processes it into narrow strip steel for export. - ④ Differences in import duty rates (imported components > finished products)

During processing trade, if the import duty rate of imported components is higher than that of finished products, conducting a "one-day tour" for the finished products under the manual allows enterprises to complete manual verification while importing the finished products (for domestic sales) at a lower duty rate. - ⑤ Differences in tax rebate rates vs. customs duty rates (tax rebate rate > customs duty rate)

Example: For zero-tariff equipment, domestic trade transactions do not qualify for tax rebates. In this case, enterprises can export the equipment to the bonded logistics center for a "one-day tour" to obtain the tax rebate.

Guangzhou Suixin Logistics Co., Ltd. provides professional assistance for enterprises utilizing the bonded zone "one-day tour" service, including:

- Guidance on document preparation for goods entry/exit from bonded zones, ensuring compliance with customs requirements

- Coordination with bonded logistics centers and customs authorities to accelerate clearance (1-2 hours as standard)

- Assistance in verifying processing trade manuals and claiming export tax rebates for upstream enterprises

- Customized solutions based on product characteristics (e.g., semi-finished products, imported components) to maximize cost savings

- Real-time tracking of goods movement in the bonded zone to ensure transparency and timeliness

Leveraging our expertise in bonded zone regulations and processing trade procedures, we help enterprises optimize their supply chain, reduce logistics costs, and accelerate capital turnover through the "one-day tour" service.

One-to-One Service

One-to-One Service Fast Turnaround Cycle

Fast Turnaround Cycle Two Decades of Import & Export Experience

Two Decades of Import & Export Experience Numerous Successful Cases

Numerous Successful Cases

Online Consultation

Online Consultation