China Import Customs Clearance (Chinese Agencies Handled)

Why choose an import agent company? How does it compare to applying for import and export rights independently? This article explains the advantages of using an import agent and outlines the detailed agent import process of Guangzhou Suixin Logistics Co., Ltd.

Using an import agent offers several key advantages compared to handling import and export procedures independently, especially for small and medium-sized enterprises (SMEs):

-

Lower Cost for SMEs: For SMEs with an annual export volume of less than 2 million US dollars, the initial cost of applying for import and export rights independently is relatively high. This includes costs for finance, foreign exchange verification, operations, personnel, and communication with banks, customs, and tax authorities. Entrusting these procedures to an agent reduces overall costs and improves efficiency.

-

Flexibility for Future Scaling: Some companies may be hesitant to cooperate with agents, assuming they will expand their business scale later and prefer to build an in-house team. However, partnering with an agent now allows cost savings and efficiency improvements in the short term. When the company grows to a certain scale, it can still hire an in-house team if necessary.

-

Advance Tax Rebate Disbursement: A critical advantage is that foreign trade agents can advance tax rebates. In contrast, applying for tax rebates directly from the tax bureau typically takes 3 to 6 months, and even longer in some regions. The time cost of this tax rebate fund is offset by a reasonable agency fee, which is lower than the cost of hiring a full in-house team.

-

Trustworthy Service for Long-Term Win-Win: Concerns about service quality, credibility, and the security of goods, funds, and customer information are common among companies or SOHO (Small Office/Home Office) operators. For formal agent companies like Guangzhou Suixin Logistics Co., Ltd., long-term development relies on growing with clients and achieving mutual benefit. Compromising customer information security or failing to ensure goods/fund safety would undermine stable long-term cooperation and mutual benefits.

Tips for Selecting an Agent Company: It is recommended to choose a foreign trade agent with a long track record, large scale, and reasonable fees for reliability. Guangzhou Suixin Logistics Co., Ltd. has been engaged in import and export agency services for over a decade, with well-established customs declaration, transportation, and warehousing departments. We provide professional one-stop import and export services, significantly reducing clients’ import costs and time.

-

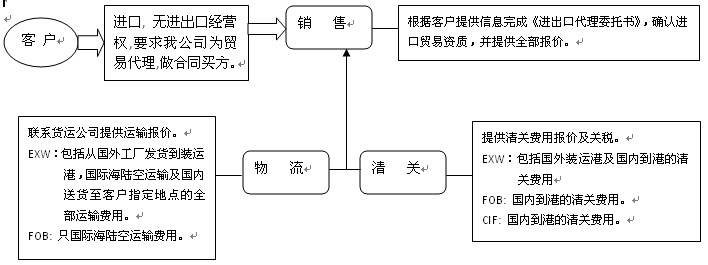

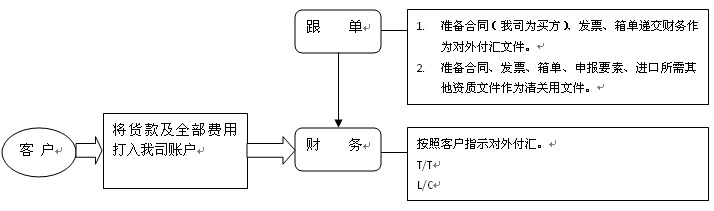

1. Preliminary Consultation and Agreement Signing:

Our team communicates with the client to understand the details of the imported goods (e.g., product type, quantity, country of origin, and destination port). We then sign a formal import agency agreement, clarifying rights, obligations, service scope, and agency fees to ensure transparency. -

2. Document Preparation Assistance:

We guide the client in preparing necessary import documents, including:Our team pre-reviews the documents to ensure compliance with customs and inspection requirements, avoiding delays due to incomplete or incorrect documents. -

Commercial invoice, packing list, and sales contract (provided by the foreign supplier)

-

Certificate of Origin, inspection certificate, and health certificate (as required by the importing country)

-

Client’s business license, tax registration certificate, and other relevant qualification documents

-

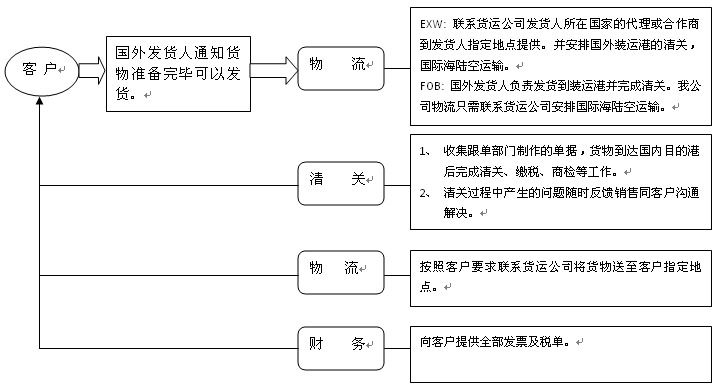

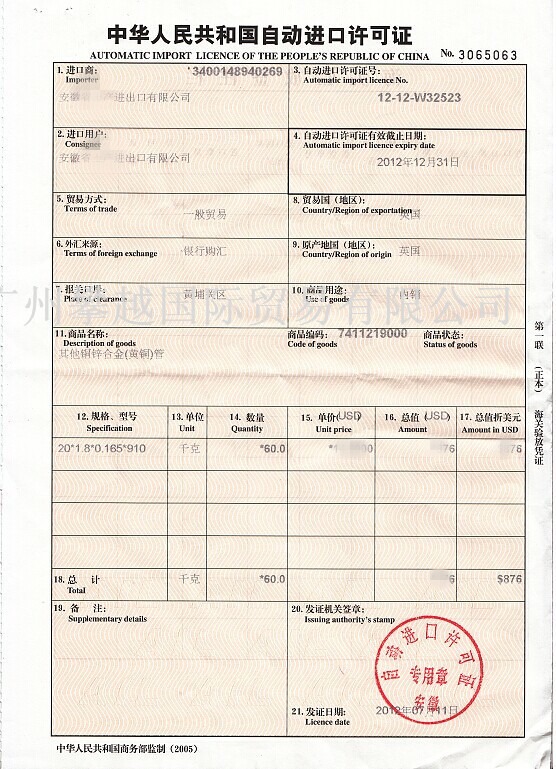

3. Customs Declaration and Inspection Coordination:

1. Our professional customs declarants submit the prepared documents to the customs for import declaration, ensuring accurate filling of information such as HS code, product name, quantity, and value.

2. For goods requiring statutory inspection, we coordinate with the inspection and quarantine department to arrange on-site inspection (if needed) and obtain the Import Goods Clearance Certificate to ensure smooth customs clearance. -

4. Logistics and Warehousing Arrangement:

We collaborate with reliable international logistics providers to arrange transportation (sea freight, air freight, or land transportation) based on the client’s needs. After the goods arrive at the port, we coordinate with the warehouse to handle unloading, storage, and delivery to the client’s designated location, ensuring the safety and timeliness of the goods. -

5. Tax Payment and Clearance:

After the customs reviews the declaration documents and issues a tax bill, we assist the client in verifying the tax amount (customs duty, value-added tax, etc.) and arrange tax payment. Upon successful tax payment, the customs releases the goods, and we complete the final clearance procedures. -

6. Post-Clearance Services:

After the goods are cleared, we provide the client with all clearance documents (customs declaration form, tax payment certificate, etc.) for financial accounting. For eligible goods, we also assist in handling import tax refund procedures (if applicable) to maximize the client’s cost savings.

Guangzhou Suixin Logistics Co., Ltd. offers tailored agent import services to address clients’ core needs:

-

Customized solutions based on the type of imported goods (e.g., food, machinery, electronics) to ensure compliance with specific regulatory requirements

-

Real-time tracking of the entire import process, providing clients with timely updates on goods status and clearance progress

-

Cost optimization advice, including selecting the most economical logistics routes and leveraging preferential tax policies (if applicable)

-

Strict confidentiality of client information and goods/fund security measures to protect clients’ business interests

-

After-sales support to resolve any issues arising from post-clearance transportation, storage, or document management

With our in-depth expertise in import regulations and industry experience, we help clients navigate complex import procedures, minimize risks, and achieve efficient, cost-effective import operations.

One-to-One Service

One-to-One Service Fast Turnaround Cycle

Fast Turnaround Cycle Two Decades of Import & Export Experience

Two Decades of Import & Export Experience Numerous Successful Cases

Numerous Successful Cases

Online Consultation

Online Consultation